UK Plastic Packaging Tax

UK Plastic Packaging Tax

From the 7th April 2022, plastic packaging components manufactured in and imported into the UK will be liable for a specific material tax where it does not meet a minimum recycled content of 30% by weight.

What is the Tax?

The Plastic Tax is a measure put in place by HMRC as part of the UK’s Resource and Waste Strategy to encourage the usage of recycled material in plastic packaging in the UK.

Who is Liable?

Liability sits primarily at one of two parties in the supply chain depending on the source of the material:

For Plastic Packaging Imported into the UK – The business who first takes ownership of the packaging in the UK would be liable.

For Plastic Packaging Manufactured in the UK – The first business who manufactures a finished plastic packaging component would be liable.

What classes as a Liable Plastic Packaging Component?

- A finished piece of packaging where plastic is the majority material by weight.

- Components are reviewed separately so a Bottle and a Cap would be treated as individual components, despite forming part of the same finished consumer product.

How Much will the Tax cost? And how is it paid?

- Plastic Packaging Components where the amount of plastic in the component does not contain 30% recycled content by weight will be charged at a rate of £200 per Tonne.

- Components with a plastic content exceeding 30% recycled content will not be liable for the tax.

- Businesses manufacturing or importing Liable components will be required to submit quarterly returns to HMRC detailing how much liable packaging they have handled and pay the associated tax.

Are there any exemptions?

Currently there are two accepted exemptions proposed by HMRC:

- Plastic Packaging for human medicines

- Plastic transit packaging in the form of shrink wrap around imports.

Financial Impacts – Direct vs Indirect Taxpayers

The financial impacts of the tax on businesses will depend on whether they are a Direct or Indirect taxpayer:

Direct Taxpayers – These are businesses either Importing or Manufacturing Plastic Components, these businesses will have to submit data to HMRC each quarter covering:

- The amount of plastic packaging manufactured or imported (regardless of its recycled content)

- The proportion of this material that exceeds 30% recycled content, including evidence of the recycled content.

- The proportion of this material that is exempt from the tax.

- The amount of liable plastic packaging exported (for rebate purposes)

It is expected that Direct Taxpayers will see administrative costs associated with the collection and submission of data to HMRC as well as the £200 per tonne tax cost.

Indirect Taxpayer – These are businesses who handle plastic packaging but do not class as the first liable party in the UK and therefore would not pick up the tax directly.

Indirect taxpayers will likely see the cost of plastic packaging handled increase by the £200 per tonne taxation rate where the recycled content is less than 30%.

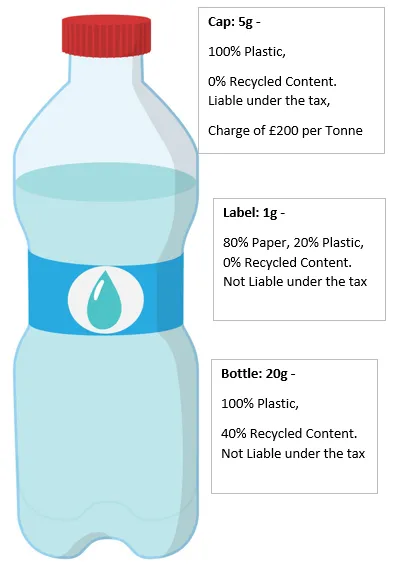

A Visual Example

Below is a visual example of how the tax applies to different components in a bottle of water: